Image

Let us know what matters most to you as we plan our 2025 budget! Help shape future City services and decisions by providing your feedback by January 26, 2025.

Guided by Council Priorities, our annual budget is part of a five-year financial plan that sets out the planned services and initiatives for the next five years, and how the City will pay for them.

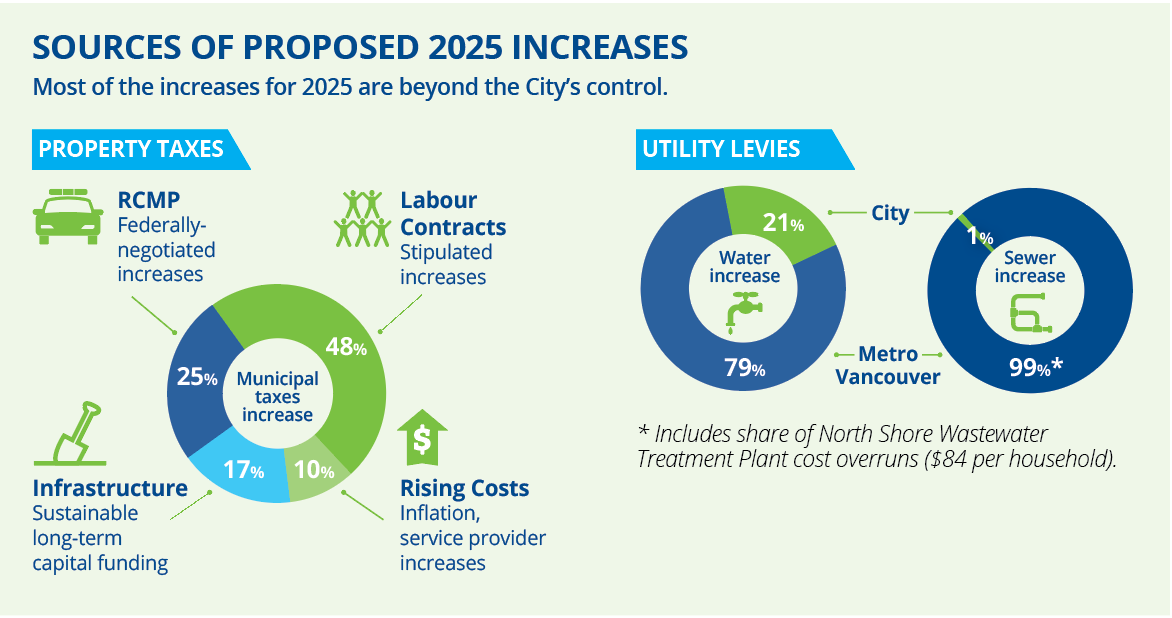

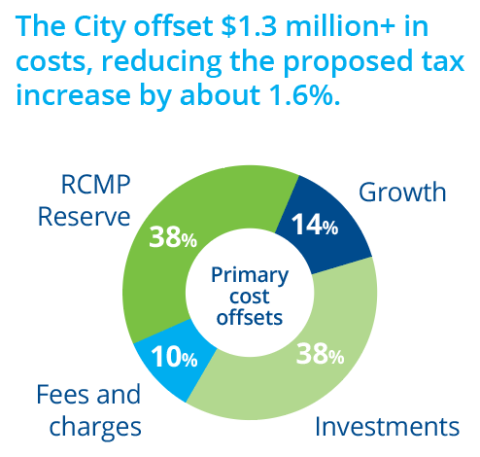

We are seeking public input on a budget with a proposed property tax increase of $95.82 (4.3%) for the average home – almost three-quarters of which relates to obligatory costs such as the federally-negotiated RCMP contract (1.43%) and labour contracts. Likewise, Metro Vancouver utility charges will make up the vast majority of the 2025 utility bill increases.

Port Coquitlam has an established track record of lower-than-average property taxes and utilities compared to other municipalities in Metro Vancouver, and is on track to continue that trend in 2025 with one of the lowest proposed tax increases in the region.

From left to right: Cllr. Glenn Pollock, Cllr. Dean Washington, Cllr. Nancy McCurrach, Mayor Brad West, Cllr. Paige Petriw, Cllr. Steve Darling and Cllr. Darrell Penner.

Port Coquitlam’s $144-million draft 2025 budget once again strives to shield taxpayers from rising costs – both those within the City’s control and beyond it – while continuing to provide essential civic services.

Almost three-quarters of this year’s proposed increase relates to obligatory costs such as the federally-negotiated RCMP contract (1.44%) and labour contracts. Likewise, Metro Vancouver utility charges will make up the vast majority of the 2025 utility bill increases.

Image

More details about costs faced by the City:

The City’s draft budget and service delivery for 2025 are guided by the 2023-2026 Council priorities along with community feedback received throughout the year through the annual budget survey and other public consultation.

Overall, the draft budget reflects the City’s ongoing focus on getting the basics right – planning and providing core municipal services (such as roads, utilities and other infrastructure, safety and recreation) that matter to residents and businesses.

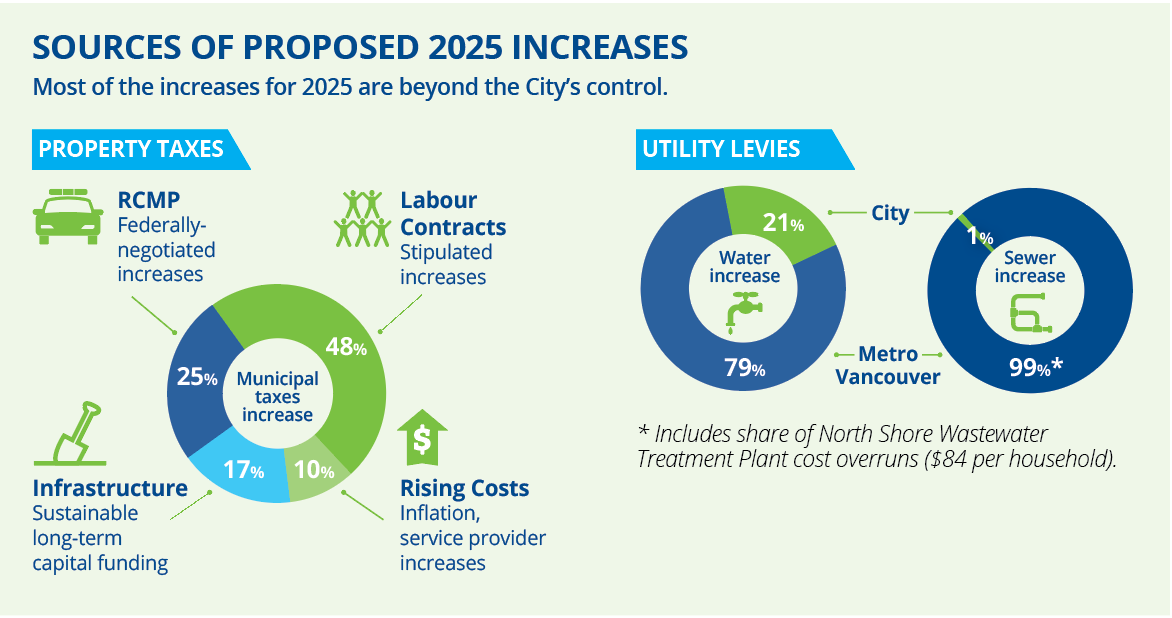

The City used a variety of tactics to reduce taxpayer impact, including:

As a result, Port Coquitlam’s proposed tax increase for 2025 is well below average in Metro Vancouver, based on reported information. Over the past five years, the City’s tax and utility increases have been just over half of the regional average.

See the How We Compare section below.

Municipal property taxes and levies for the average Port Coquitlam home (assessed at $1,108,776) are proposed to increase in 2025 by $95.82 (4.3%) – one of the lowest proposed increases in the region. A similar percentage increase is proposed for business taxes.

Image

Regional funding pressures will significantly impact the 2025 utility levies. Metro Vancouver water charges will make up 80% of the water levy increase and 99 per cent of the sewer levy increase. The largest portion of the sewer levy increase ($84 from each household) is due to the North Shore Wastewater Treatment Plant cost overruns being felt throughout the Lower Mainland.

Please note: These figures are based on last year’s property assessment values and do not include the regional and provincial taxes that also appear on the annual property tax bill and are beyond the City’s control. See below about the potential impact of a property’s assessed value.

Sign up for the City’s Prepayment Plan to pay next year’s tax and utility bills in easy monthly instalments.

The City’s annual budget pays for a wide variety of important City services (see the Where Do My Taxes and Levies Go tab below.)

Overall, the 2025 budget is lean and focuses primarily on maintaining existing service levels and taxpayer affordability. However, the City remains committed to delivering the highest standard of service in areas such as parks and waste management, which have earned widespread recognition across the region.

A notable service enhancement for 2025 is the introduction of curbside glass collection for homes that pay a solid waste levy on their tax bill. This expanded service is being provided in response to long-time community requests.

The annual budget also funds a variety of capital improvements through the 2025-2026 Capital Plan, including significant investments in flood protection.

A property’s assessed value determines its share of taxes. The assessments provided by BC Assessment each January indicate how much Port Coquitlam property assessments increased or decreased from the prior year.

Properties whose value has increased or decreased more or less than other typical properties of the same type will experience a tax rate that differs from the average. For more details, see the assessment mailed to you the week of January 15.

This is how your annual City property taxes and levies are applied to a wide variety of important services and programs.

The budget survey is an important source of information for Port Coquitlam, providing insights about community priorities that not only help finalize the draft budget, but guide City decision-making and actions throughout the year.

Residents of the City who complete the budget survey can also be entered into a draw for a $150 gift card to a Port Coquitlam business of their choice (one entry per household).

Have questions or want to learn more about a project, contact us below:

| Phone | 604.927.5411 |

|---|---|

| Website | www.portcoquitlam.ca |

| In writing | 2580 Shaughnessy Street |

This site is owned and operated by the City of Port Coquitlam using software licensed from Social Pinpoint. We take appropriate measures to safeguard personal information and use encryption, access controls, and other security measures to protect it. For details on what personal information we may collect and access, please refer to Social Pinpoint's Privacy Policy.

Users have the right to access, correct, or delete their personal information, subject to certain exceptions. For details on how to exercise these rights, or for any questions or concerns about our privacy practices, please contact us in writing at [email protected].

This privacy policy may change from time to time, and any changes will be communicated to users through the site.

The following Terms and Conditions govern the use of Let's Talk PoCo (“the site”). The software platform is owned by Social Pinpoint Pty Ltd and operated by us, City of Port Coquitlam.

By accessing and using this site, you are choosing to accept and comply with the Terms presented throughout this agreement as well as the Privacy Policy and Moderation Policy. These Terms apply to all visitors and users of this site. Linked sites, affiliated services or third party content or software have their own Terms that you must comply with. If you disagree with any of the Terms presented in this agreement, you may discontinue using the site immediately.

If you are under 18 years old, please ensure that your parent or guardian understands and accepts these Terms and Conditions (including the Privacy Policy and Moderation Policy).

What are the conditions with a user’s account?

While using the site, you must not violate any applicable laws and regulations. It is our duty to protect the confidentiality of content you provide on our site in accordance with our Privacy Policy. When you create an account with us, you must always provide us with accurate information. Failure to provide accurate information violates the Terms, which may result in immediate termination of your account on our service. You are responsible for protecting your own password you use for this site and for any activities done under that password. Unauthorised use of your password or account must be immediately reported to us. In some cases, we or our agents may require access to your user accounts to respond to technical issues.

We are not responsible for the content on the site that has been provided by the users of the site. Any content posted by you is subject to the rules of our Moderation Policy. Your contribution to the site may be edited, removed or not published if we consider it inappropriate (refer to Moderation Policy). Contributors should also be aware that their posts may remain online indefinitely. Where practical, you may choose not to identify yourself, deal with us on an anonymous basis or use a pseudonym.

What do we require from our users?

You must understand and agree that, without limitation:

Can your account be suspended or terminated?

We may terminate or suspend access to your site and/or account immediately, without prior notice, including without limitation if you breach the Terms. We may immediately deactivate or delete your account and all the related files and information in your account. After your account has been terminated, the content you have posted may also remain indefinitely on the site.

If you want to terminate your own account, please send an email to [email protected].

Governing Law

These Terms shall be governed in accordance with the laws of the State of Delaware, the United States of America and Queensland, Australia, without regard to its conflict of law provisions.

Indemnification

City of Port Coquitlam, its subsidiaries, affiliates, officers, agents, licensors and other partners are not responsible for any loss, liability, claim, or demand, including legal fees, made by any third party due to or arising from a breach of this agreement and/or any breach of your representations and warranties set forth above.

What content do we own?

This website contains the copyrighted material, trademarks, patents, trade secrets and other proprietary information (“Intellectual Property”) of City of Port Coquitlam and its suppliers and licensors. City of Port Coquitlam owns and retains all proprietary rights in the intellectual property. All intellectual property in the content of this site including without limitation to text, software, source code, pages, documents and online graphics, photographs, sounds, audio, video and other interactive features are owned by or licensed to us.

Any original content that you submit or post on our site may be made available to the public and allows users to share your content (with the end user acknowledging your contribution) under the Creative Commons Attribution-ShareAlike 4.0 License.

Except for Intellectual Property which is in the public domain or for which you have been given written permission, you may not copy, alter, transmit, sell, distribute any of the Intellectual Property on this site.

We are not responsible for your communications or dealings, including payment and delivery of goods or services, with a third party found via our website. Any loss or damage incurred from those communications or dealings are solely between the user and the third party.

Disclaimer and Warranties

Users must agree that you use of the site is at your own risk. We make no warranty that the site will meet your requirements or be uninterrupted or error-free. Any material that the user downloads through the site is done at their own risk and are responsible for any damages to their computer system or loss of data.

What happens if these Terms change?

We reserve the right, at our sole discretion, to modify or replace these Terms at any time without notice. The most recent version of the Terms can be seen on this page. By continuing to access or use our site after those revisions become effective, you agree and will comply to the revised terms. If you do not agree to the revised terms, please discontinue using our site.

Contact Us

If you have any questions about these Terms, please contact us at [email protected].

Enter your email address below. We will send you instructions to reset your password.

Back to Log in

Sign up for Let's Talk PoCo, our online engagement tool, to get notified about opportunities to provide input on community priorities that inform decision-making throughout the year.

Already have an account? Log in now

Thank you, your account has been created.

Completing the questions below helps us better understand the diverse range of people who contribute their ideas. The questions are optional.

You’re using an outdated browser.

Some features of this website may not work correctly. To get a better experience we strongly recommend you download a new browser for free:

Would you like to follow this project to receive email updates?